“From tech titans to deal dynamos—let’s decode the ultimate acquisition game in the software world!”

Introduction

In the high-stakes game of technology, where innovation and adaptation are the ultimate currency, mergers and acquisitions (M&A) are the power moves that separate the players from the contenders. For software companies, these strategic deals are key to maintaining dominance in an increasingly competitive and fast-moving market. M&As aren’t just about merging teams or acquiring assets—they’re about securing new markets, strengthening portfolios, and positioning for future growth. Think about it: the biggest global software solutions providers, from CRM software giants to fintech software innovators, are leveraging acquisitions to level up faster than ever.

When we talk about the top software companies today, it’s not just their product offerings that make them stand out—it’s their M&A strategies. Through clever business acquisitions, software companies are tapping into new technologies, expanding global reach, and securing a competitive edge that’s hard to beat. Whether it’s a small business merger and acquisition or a major IT software company stepping into a new market, these moves are shaping the landscape in big ways. For business acquisition companies and those in the acquisition finance sector, the tech world is where the action is, and it’s only getting bigger.

Let’s break it down and take a look at how these merger acquisition companies are shaking up the industry, with recent examples, key trends, and the stats that show why software companies are leading the way in M&A activity.

Why Mergers and Acquisitions Are a Game Changer for Software Companies

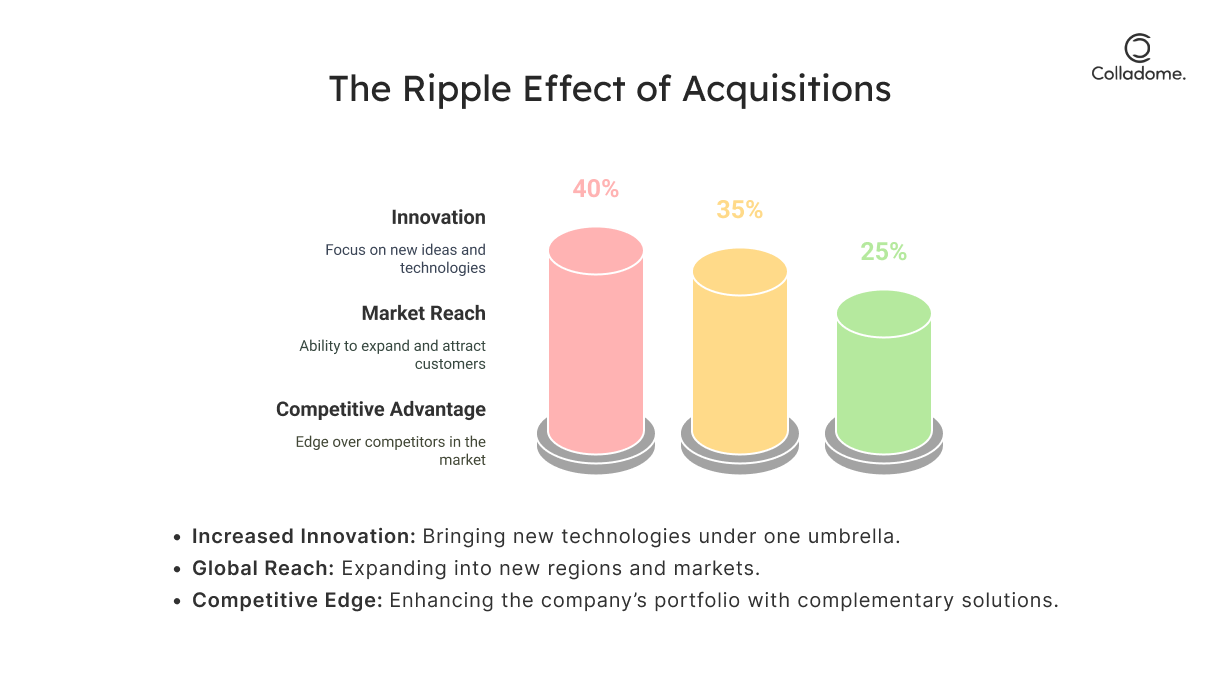

Mergers and acquisitions (M&A) aren’t just business moves—they’re the secret weapon that keeps top software companies ahead of the curve. Here’s why they’re crucial:

1. Strategic Growth

Acquisitions let software companies rapidly integrate new technologies and expand into fresh markets. Whether adding the best CRM software or tapping into fintech software, M&As unlock new opportunities for growth and innovation. Global software solutions become instantly accessible, turning competitors into partners.

2. Competitive Edge

In an industry driven by AI, cloud computing, and cybersecurity, M&As offer companies a way to quickly gain a foothold in cutting-edge areas. By merging with other tech innovators, businesses can leapfrog over competitors and dominate emerging markets. It’s not just about staying relevant—it’s about leading the pack.

3. Scalability

M&As allow companies to scale faster and smarter. Combining resources and talent leads to economies of scale, boosting efficiency and cutting costs. Whether it’s a small business merger or a giant acquisition, this synergy helps IT software companies expand at breakneck speed, increasing their market share and operational power overnight.

Key Concepts of Software M&A

Mergers and acquisitions in the software industry are more than just corporate chess moves—they’re power plays that fuel innovation, market expansion, and competitive dominance. Let’s break down the key concepts that make M&A a must-have strategy for the best software companies:

1. Merger of Acquisition vs. Acquisition Finance

-

- Merger of Acquisition: It’s like tech dating—two companies coming together, sharing their strengths, and merging as equals. Think of it like a perfectly synced duo—each bringing something unique to the table, whether it’s top CRM software or next-gen tech solutions.

- Acquisition Finance: This is the more aggressive move—one company swallowing up another. One entity absorbs the other’s assets, team, and tech, leading to business acquisitions that make competitors nervous. Whether it’s gaining fintech software expertise or a global software solution, acquisitions offer power-packed results quickly.

2. Small Business M&A

Small business mergers and acquisitions pack a big punch when it comes to niche capabilities. These smaller acquisitions are key in industries like SaaS and fintech, where specialized technology and domain expertise can be the deciding factor. Think of it as a rapid expansion strategy—a smaller software company snags a unique innovation or product to catapult it to the top.

3. Global Software Solutions

In today’s digital world, M&A doesn’t just happen locally—it’s global. With the rise of cross-border mergers and acquisitions, software companies are no longer limited by geographic boundaries. A business acquisition company might target firms from different continents, aiming to integrate global software solutions that allow them to scale internationally. This trend shows how the tech landscape is becoming a globalized race, where companies are always looking for the next big acquisition to dominate new markets.

In summary, M&A in the software industry isn’t just about survival; it’s about scaling, innovating, and dominating. Whether you’re eyeing a merger to amplify capabilities, or eyeing a small business acquisition to enhance your fintech portfolio, these moves are essential for global software solutions.

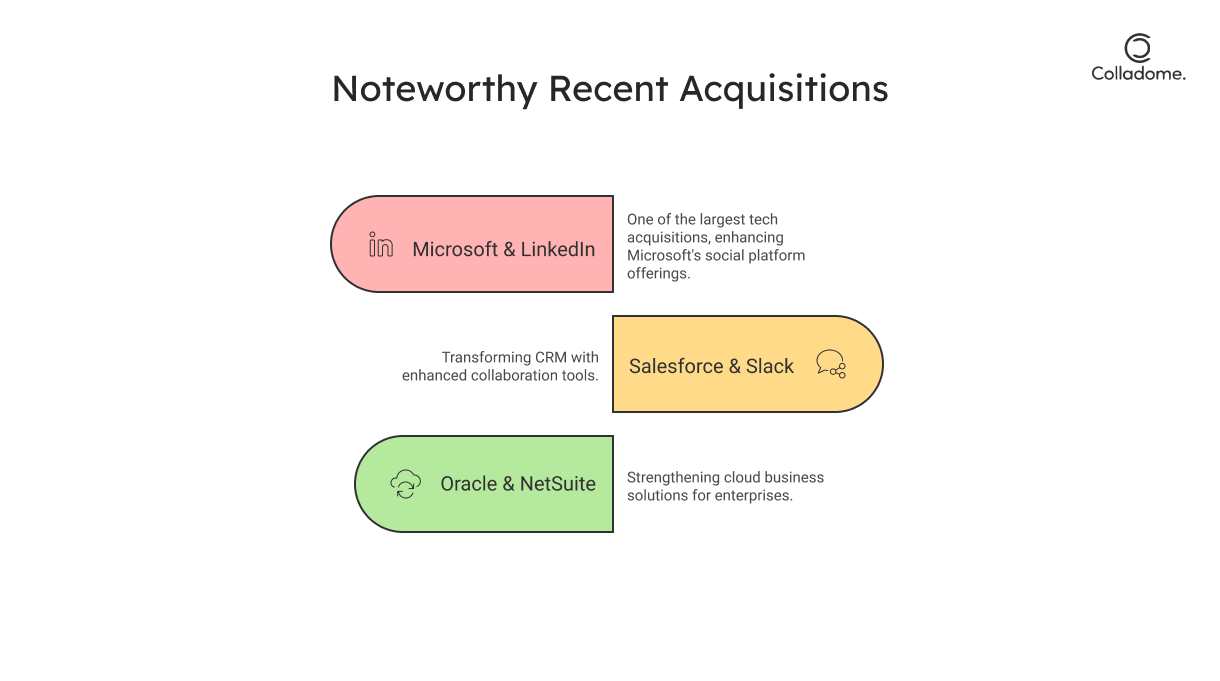

Recent Major Acquisitions in the Software Industry: Giants Making Waves

When it comes to mergers and acquisitions in the software world, the big players know how to dominate. Here are some recent game-changing moves from the top software companies globally, and a few India-specific examples that are reshaping the landscape:

Global Leaders

Microsoft

- LinkedIn ($26.2 billion in 2016)

Microsoft didn’t just want to be known for its office software; it wanted to control the professional networking space. LinkedIn was a strategic acquisition that allowed Microsoft to integrate professional networking tools into its global software solutions, complementing everything from CRM to cloud services. This is what you call playing in the big leagues, right? - Activision Blizzard ($68.7 billion in 2023)

Microsoft made headlines with its jaw-dropping acquisition of Activision Blizzard to expand into gaming. With Xbox in its pocket and a stake in the gaming industry, Microsoft is betting on the metaverse, making this deal a massive part of its strategy to corner the entertainment market alongside enterprise software solutions. Talk about business acquisition on a whole new level!

Cisco

- Splunk ($28 billion in 2024)

Cisco isn’t just about networking hardware anymore; it’s aiming to be the AI-powered data powerhouse of the future. By acquiring Splunk, Cisco is looking to enhance its cybersecurity and observability capabilities, adding big data solutions to its portfolio. This acquisition proves that global software leaders are all-in on securing data for the next wave of enterprise growth.

IBM

- HashiCorp ($6.4 billion in 2024)

The IT software company IBM is doubling down on cloud infrastructure with its latest acquisition of HashiCorp. This deal focuses on infrastructure-as-code platforms, giving IBM a cutting-edge edge in cloud automation and deployment tools. IBM is positioning itself as a key player in the cloud-native era, making this acquisition a solid bet on future-proofing its business in the rapidly evolving cloud software space.

India-Specific Examples

Infosys

- BASE Life Science (€110 million in 2024)

Infosys is not just about IT services anymore; it’s taking a more aggressive stance in the digital health and fintech software spaces. By acquiring BASE Life Science, Infosys has further cemented its role as a global software player, integrating healthcare technology into its vast portfolio. This is an example of business acquisition companies making bold moves in niche sectors to broaden their scope.

Tata Consultancy Services (TCS)

- German Software Firm (2023)

TCS continues to rise as a leader in AI and cloud services. By acquiring a German software firm, they’re expanding their capabilities in these cutting-edge areas, positioning themselves to tackle both AI-driven solutions and cloud software more strategically. As part of TCS’s push to scale globally, this deal helps it tap into emerging markets and technologies, further establishing its dominance.

Why These Moves Matter

These company acquisitions and mergers are all about one thing: scaling smartly. Whether it’s expanding into fintech, enhancing cloud computing capabilities, or securing new global software markets, these companies are ensuring they stay ahead of the curve.

So, if you’re a small business or an IT software company hoping to play in the big leagues, these business acquisition strategies are the secret sauce to long-term growth and relevance. Keep an eye on how these moves shake up the global software solutions market—and how they impact everything from customer engagement with the best CRM software to AI-powered business intelligence.

How M&A Trends are Shaping the Future: Insights for Businesses

The software industry isn’t just about cutting-edge tech—it’s also about who you partner with, who you acquire, and how you scale globally. Mergers and acquisitions (M&A) are driving some of the most exciting trends in the tech world, and if you’re a player in the software space, it’s time to pay attention. Here’s how M&A is shaping the future and why it’s crucial for businesses to keep up with the game:

1. Adopting AI

- Why It’s Happening: AI isn’t the future—it’s the now. Companies are going all-in on AI, and to stay competitive, they’re snapping up AI-driven startups left and right. Take Nvidia’s acquisition of Run.ai for $700 million. Nvidia wanted to beef up its automation capabilities and boost its AI platform—an acquisition that positions it to dominate industries looking for smarter, more efficient tech solutions.

- What It Means for Businesses: If you’re not thinking about AI in your strategy, you’re falling behind. Expect more M&A deals in the AI space, as companies look for ways to integrate cutting-edge AI technologies into everything from their products to customer service. Look out for fintech software and cloud companies with powerful AI capabilities—they’re going to be the hot targets in the coming years.

2. Expanding Market Reach

- Why It’s Happening: Global expansion is the name of the game. To scale globally, businesses need to tap into untapped markets and new regions. A prime example is Thoma Bravo’s acquisition of Darktrace for $5.3 billion in 2024, a move designed to dominate the global cybersecurity landscape.

- What It Means for Businesses: M&A is about growing smarter. You’re not just acquiring tech or products, you’re acquiring access to new customers, new regions, and new revenue streams. Want to expand your footprint? Watch for global software giants eyeing business acquisition opportunities in emerging markets and sectors, especially in fintech and cloud solutions.

3. Fostering Innovation

- Why It’s Happening: Small, agile companies can innovate at a pace that giants often can’t match. Acquiring these smaller firms allows the big players to stay innovative and ahead of the curve. WalkMe, acquired by SAP for $1.5 billion, is a perfect example. WalkMe offers unique SaaS solutions that enhance SAP’s customer journey platform. It’s all about enriching ecosystems with niche, innovative capabilities.

- What It Means for Businesses: Innovation doesn’t just come from within—sometimes you need to buy it. Small players with unique solutions are often the key to unlocking big opportunities in cloud software and the best CRM software solutions. Whether you’re a top software company or a business acquisition company, looking for small business mergers and acquisitions in the SaaS and fintech software sectors could be a game-changer.

Emerging Areas of Interest in M&A

-

Cybersecurity

With cyber threats evolving daily, businesses need robust security solutions. M&A activity in this space is booming as global software leaders merge with cybersecurity startups to stay ahead of the game. This trend is set to continue as cloud solutions and AI intersect to create next-gen security platforms.

-

Cloud and SaaS

The cloud is king, and it’s only getting bigger. SaaS and cloud-based businesses are prime targets for M&A deals, as companies look to expand their offerings and improve their scalability. For businesses, this is a sign that cloud services will dominate the software landscape, and investing in these areas is critical.

-

FinTech Software

Fintech is taking over financial services, and M&A in this sector is on the rise. Whether it’s digital payments, blockchain, or wealth management solutions, companies are looking to integrate and scale innovative fintech technologies to better serve customers and drive future growth.

| Trend | What’s Happening? | Why It Matters | Notable Moves |

| AI Acquisitions | Companies buying AI startups for automation power. | AI is the future—dominate or fall behind. | Nvidia bought Run.ai ($700M) to enhance AI. |

| Global Expansion | Acquisitions open doors to new markets. | Scale globally with ease—reach new talent & customers. | Thoma Bravo’s $5.3B acquisition of Darktrace (cybersecurity). |

| Niche Innovation | Small, innovative firms are becoming targets. | Big companies need niche tech to stay ahead. | SAP acquired WalkMe ($1.5B) for SaaS innovation. |

| Cybersecurity Surge | Rising demand for top-notch security solutions. | Businesses need to protect data more than ever. | Cisco scooped up Splunk ($28B) for security and AI. |

| Cloud and SaaS | Cloud-based solutions are stealing the show. | The cloud-first revolution is booming. | Microsoft’s $26B LinkedIn deal strengthened its cloud game. |

| FinTech Frenzy | Big tech targeting fintechs for financial disruption. | Fintech is changing the financial landscape. | IBM’s Red Hat acquisition to build out financial tech solutions. |

Real-Time Statistics

- M&A Deal Volume: The software sector’s M&A deal volume rose by 36% in Q2 2024 compared to the same period in 2023. (source)

- Average Deal Size: Large-scale acquisitions (>$1 billion) dominated, while smaller deals (<$1 billion) grew by 12%. (source)

- Regional Dynamics: North America remains the hotspot, contributing 60% of deal volume. (source)

| Year | Company | Acquisition | Value | Sector |

| 2023 | Microsoft | Activision Blizzard | $68.7 billion | Gaming |

| 2024 | Cisco | Splunk | $28 billion | Cybersecurity |

| 2024 | IBM | HashiCorp | $6.4 billion | Cloud Computing |

Conclusion

Mergers and acquisitions in the software industry aren’t just about buying and selling companies—they’re the fuel driving innovation, expansion, and the relentless evolution of technology. As the market continues to mature, we’re seeing an increasing focus on strategic acquisitions that not only build bigger portfolios but also carve out new niches in the ever-changing digital landscape. In this space, it’s not just about size—it’s about vision. Companies like Microsoft, IBM, and smaller emerging players are setting the stage for a future powered by cutting-edge technologies like AI, cybersecurity, and cloud solutions.

For those at the helm of decisions—whether you’re an investor, a tech company executive, or simply a curious tech enthusiast—understanding these dynamics is key. And here’s where Colladome enters the picture. With its deep expertise in both technology consulting and strategic acquisitions, Colladome is positioned perfectly to guide businesses through these complex waters. The future of tech is intertwined with smart acquisitions, and Colladome is at the forefront, helping businesses assess, execute, and maximize their acquisition strategies.

Call to Action

Ready to jump into the world of strategic acquisitions? Whether you’re eyeing growth, innovation, or new opportunities, Colladome is here to help you stay ahead of the curve. Explore the latest in global software solutions, M&A opportunities, and more with Colladome. Our expert consultants are geared up to guide you through the intricacies of merger and acquisition strategies, helping you make the smartest moves in today’s fast-paced tech ecosystem.