Identifying and connecting with potential clients using data-driven insights and market research.

Designing and building secure, scalable financial solutions tailored for modern banking, investment, and fintech needs.

Developing integrated enterprise resource planning (ERP) solutions to streamline business operations and enhance efficiency.

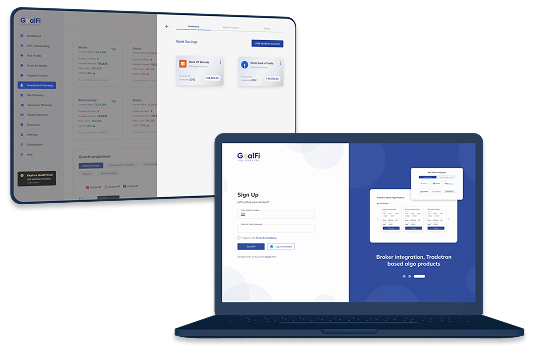

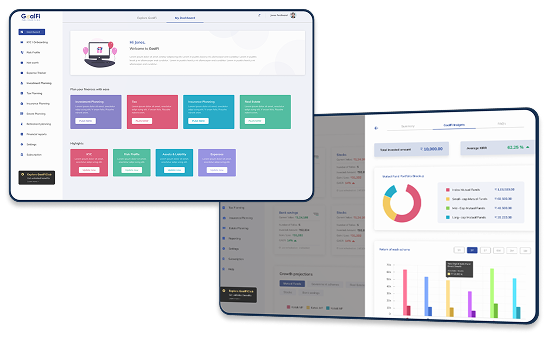

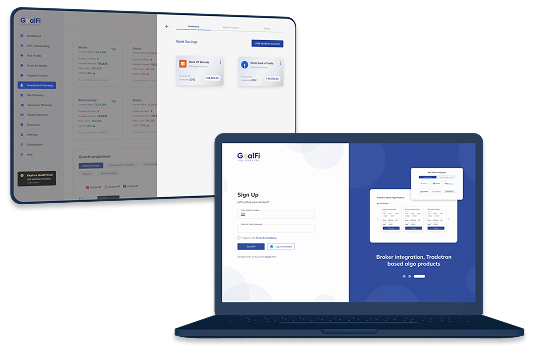

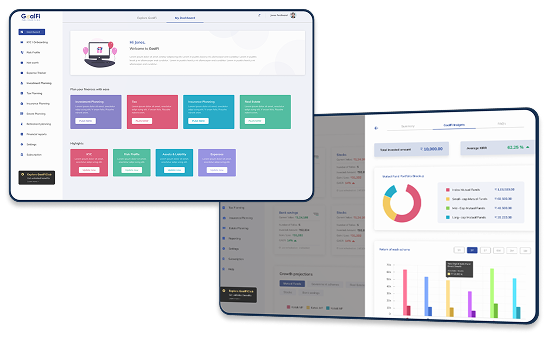

Goalfi is on a mission to transform financial literacy into financial empowerment by providing individuals with the tools and knowledge needed to achieve financial independence. In today’s fast-paced world, understanding personal finance is no longer a luxury but a necessity. Goalfi bridges this gap by offering an intuitive digital platform that simplifies complex financial concepts, helping users make informed decisions about saving, investing, and managing their money effectively. Through a seamless blend of educational content, interactive tools, and AI-driven insights, Goalfi not only equips users with financial knowledge but also empowers them to take actionable steps toward their goals—whether it’s buying a home, planning for retirement, or achieving financial freedom. With a user-friendly website and a feature-rich mobile application, Goalfi ensures accessibility for all, making financial independence attainable, one step at a time.

Financial platforms must ensure accuracy, transparency, and expert-backed content to gain user trust while overcoming skepticism.

Adapting financial education and advice to individual goals, knowledge levels, and learning styles is essential but requires complex data-driven personalization.

Users often understand financial concepts but struggle to apply them; platforms must offer actionable insights and motivation strategies to drive real-life decisions.

Maintaining compliance with financial regulations while ensuring strong data security and a seamless user experience across jurisdictions is a key challenge.

Conducted market analysis to understand user needs and preferences.

Developed a visually appealing and user-friendly interface.

Developed personalized recommendations based on user financial behaviors.

Collaborated with financial experts to create engaging and easy-to-understand content.

Built the platform using modern web and mobile technologies.

Conducted extensive testing to ensure security, functionality, and usability.

Google’s Flutter framework ensures a smooth, responsive, and visually appealing user experience across multiple devices with a single codebase.

Cross Platform: Develops apps for both Android and iOS with a single codebase.

High-Performance UI: Uses Skia rendering engine for smooth animations and responsive design.

Customizable Widgets: Provides rich UI components for tailored user experiences.

Real-Time Processing: Enables instant feedback and seamless app interactions.

Utilizes MongoDB, Express.js, React, and Node.js for comprehensive full-stack solutions.

MongoDB: A flexible NoSQL database for handling large datasets with ease.

Express.js: A reliable backend with real-time features.

React: Fast, interactive, and dynamic UI for a seamless experience.

Node.js: Efficiently handles multiple requests for optimal performance.

Security & Authentication: Implements role-based access control and encrypted data protection.

It enables real-time synchronization across devices and provides secure data storage. Its robust backend services support seamless data management and authentication.

Real-Time Data: Supports real-time data synchronization, ensuring users receive instant updates across devices without delays.

Secure Authentication: Offers built-in authentication methods, enhancing security for user login and data management.

Scalable Backend: Easily handles increasing data loads and user growth with a robust, cloud-based infrastructure.

Cloud Functions: Allows the creation of serverless functions, automating backend processes without the need for a dedicated server.

Improve financial knowledge, manage expenses, and plan for a secure future.

Professionals providing expert advice and personalized financial guidance.

Professionals providing expert advice and personalized financial guidance.

Improve financial knowledge, manage expenses, and plan for a secure future.

Professionals providing expert advice and personalized financial guidance.

Admins overseeing platform content, compliance, and user experience.

The platform’s user base grew by 50%, with a 40% rise in expert collaborations.

Users successfully reached their savings targets and investment milestones.

Users reported enhanced financial knowledge and more confident decision-making.

Retention rose significantly, with average session times increasing by 45%.

Financial literacy empowers individuals to make informed decisions about budgeting, saving, investing, and managing debt, leading to long-term financial stability.

Digital platforms use AI-driven insights, automation, and interactive tools to simplify complex financial concepts and help users make data-driven decisions.

A financial planning app typically includes budgeting tools, goal-setting features, investment tracking, personalized recommendations, and educational content.

AI analyzes user behavior, financial goals, and market trends to provide personalized insights, optimize investments, and enhance financial management strategies.

Regulations vary by region, covering data privacy (GDPR, CCPA), financial compliance (SEC, RBI), and consumer protection (CFPB, FCA).

They use encryption, multi-factor authentication, secure APIs, and compliance with data protection regulations like GDPR and PCI DSS to safeguard user information.

Beginners should focus on budgeting, setting financial goals, building an emergency fund, and gradually learning about investment options.

Regulations vary by region, covering data privacy (GDPR, CCPA), financial compliance (SEC, RBI), and consumer protection (CFPB, FCA).

Beginners should focus on budgeting, setting financial goals, building an emergency fund, and gradually learning about investment options.

Automating savings, tracking expenses, reducing unnecessary spending, and investing in diversified portfolios are key strategies for effective saving.

Goal-based investing aligns investment choices with specific financial objectives, risk tolerance, and timeframes, optimizing returns for long-term success.

Gamification, AI-driven insights, interactive tools, and personalized financial recommendations keep users engaged and encourage consistent financial planning.

Financial advisors provide expert guidance, strategy development, and personalized financial advice, often enhanced by digital tools and AI insights.

Fintech startups should focus on user-centric design, robust security, seamless integrations, and adaptive technology to meet evolving financial needs.

Edully is transforming career counseling by providing students with a data-driven and AI-powered platform to make informed decisions about their education. By addressing key challenges in the EdTech industry, it simplifies college selection, enhances scholarship accessibility, and streamlines admissions. With tailored solutions for students, counselors, and administrators, Edully bridges the gap between aspirants and institutions. Its scalable technology ensures seamless operations, security, and real-time insights, making career planning more efficient and personalized. As the education sector continues evolving, Edully remains committed to empowering students with the right tools and guidance for a brighter future.

Top B2B Companies in 2024

Top Mobile App Development Company

Top Flutter App Development Company

Top Mobile App Developers 2024

Top Mobile App Developers 2024